does binance us report to irs

According to their website. No they stopped issuing 1099-K s from 2021 so they dont report to the IRS.

Top Crypto Exchange 2022 The Exchanges To Know Zdnet

Likewise Coinbase Kraken Binanceus Gemini Uphold and other US exchanges do report to.

. I think the more precise question is does Binance global report your property to the IRS. Visit for Does Binance Report to IrsIn brief Binance is one of the most innovative cryptocurrency exchanges in the market. The Headquarters of Binance Will Report to the IRS It is true that the newly formed subsidiary by Binance complies with the laws and regulations of other states.

It is clear that BinanceUS reports to the IRS httpssupportbinanceushcen. We will file a Form 1099-K with the IRS and in some cases certain state authorities to report transactions by Binance US customers in each year where we are. Binance does not report any crypto asset to the IRS.

We will file a Form 1099-K with the IRS and in some cases certain state authorities to report transactions by BinanceUS customers in each year where we are required to do so under. Go to the Binance. Binance a Malta-based company is one of the most popular crypto exchanges in the world.

Binance US shares customer data with the IRS every time they issue a 1099-MISC form to a user as the IRS gets. However it is no longer serving US-based traders so Binance does not report to the IRS. Does Binance US report to the IRS.

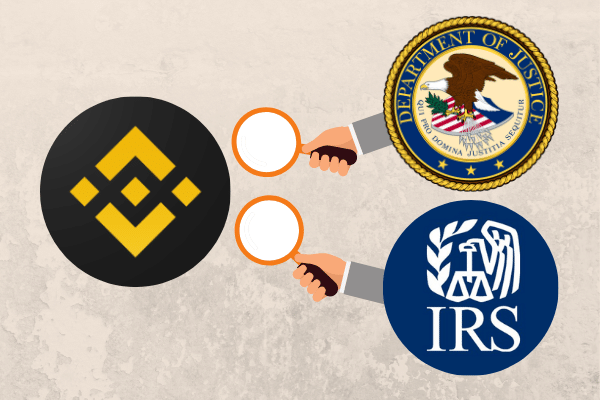

Visit for Does Binance Us Report to IrsIn brief Binance is one of the most innovative cryptocurrency exchanges in the market. They can request your data from any larger crypto exchange. The irs and doj are probing binance employees for information related to money laundering and tax offences according to reports.

Does Binance US report to IRS. Check it out Does Binance Us Report to Irs. Does BinanceUS report to the IRS.

Binance US reports to the IRS. Currently the HMRC has to state that they have notified. Kraken does not report unless they are asked to provide.

Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. Coinbase Coincase Pro Gemini and Binance US all report when we hit both 200 transactions and 20000 within a calendar year.

So it is pretty much more. If you earned at least 600 through staking or. Go to the Binance registration pageBinance.

What does the IRS do with the. Previously BinanceUS took the position that it was a Third Party. For legal reasons binance operates in the.

Does Binance us send out 1099. However BinanceUS does report to the IRS. However it is no longer.

In this blog post we will look at does binance report to IRS what we know about Binance and taxes and try to answer the question. The HMRC Her Majestys Revenue and Customs is the UKs equivalent to the IRS. Does Binance Report to HMRC.

Will Binance us send a 1099. If you receive a Form 1099-B and do not report it the same principles apply. In brief Binance is one of the most innovative cryptocurrency exchanges in the market.

Does Binance report to the IRS. It is also important to note that Binance has a separate website for the. While Binance US might not be sending out 1099-K forms the IRS is taking a hard stance on crypto tax evasion.

This Form 1099-B that BinanceUS uses to report to the IRS in the future will contain detailed information about all cryptocurrency disposals on the platform. Go to the Binance.

Crypto Taxes How To Calculate What You Owe To The Irs Money

Does Binance Report To The Irs Coinledger

Binance Us Eliminates Spot Trading Fees On Bitcoin Wsj

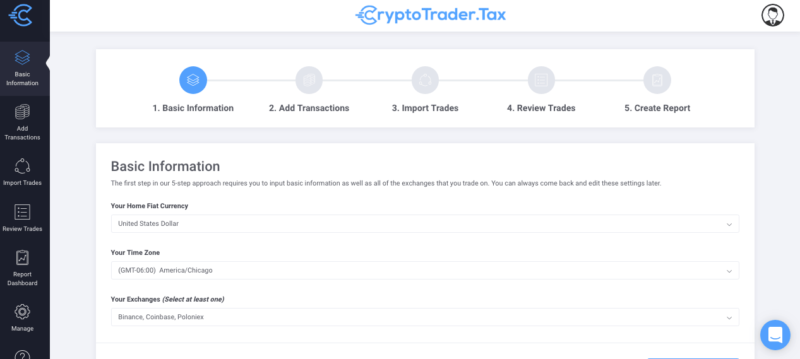

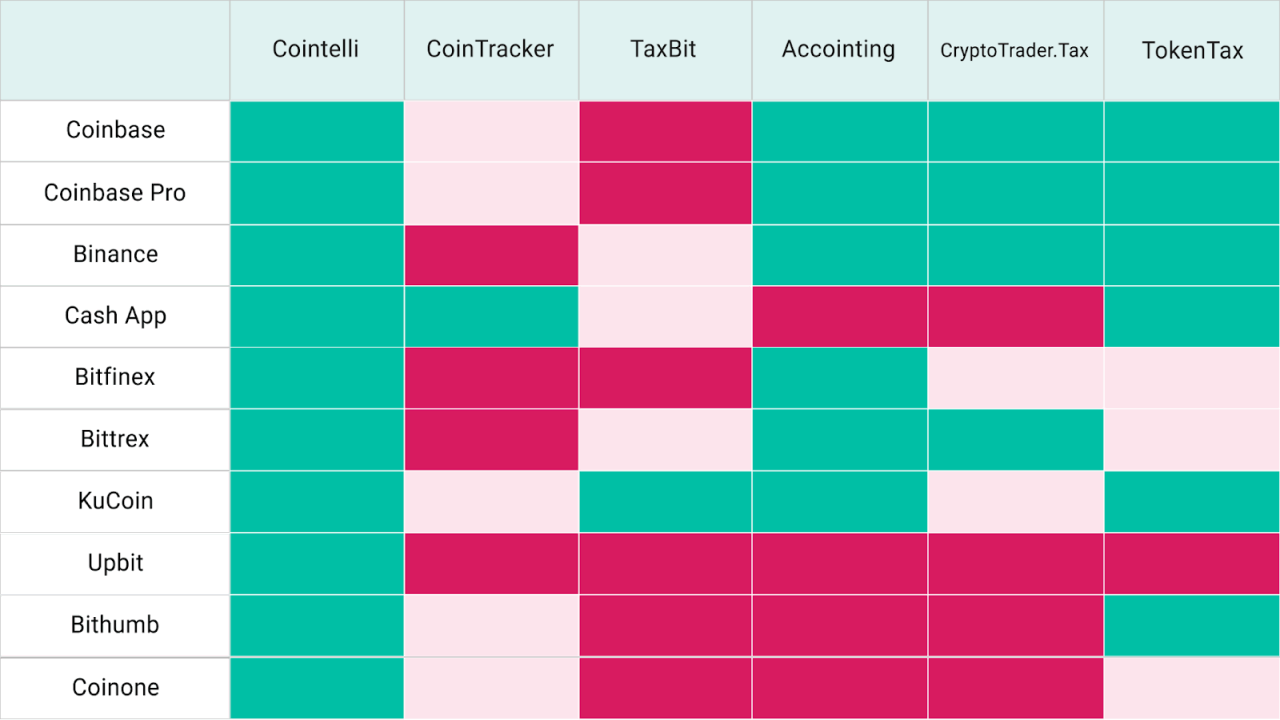

Cointelli Makes It Easy To Report Coinbase Binance And Kraken Transactions To The Irs Sponsored Bitcoin News

Taxbit Automate Your Cryptocurrency Tax Forms For Free Taxbit

Does Binance Report To Irs Cryptalker

Binance Us Launches Tax Statements Portal And Joins Taxbit Network Taxbit

How To Do Your Binance Us Taxes Koinly

How The Irs Knows You Owe Crypto Bitcoin Taxes Cointracker

Cryptocurrency Tax Reporting 101 Binance Us

How To Connect Binance Us With Koinly

Binance Appoint Ex Irs Agent To Lead Its Sar Unit

Tips For Avoiding A Crypto Tax Audit Zenledger

Binance Us Review Is Binance Lite Worth Your Time And Crypto

Binance Under Investigation By Us Justice Department And Irs Supercryptonews

Crypto Exchange Binance Us Valued At 4 5 Billion After Inaugural Funding

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

Binance Hires Former Irs Special Agent To Head Suspicious Activity Reporting